Meaning of annuity, annuity examples and types of annuity

What is the best example for annuities? annuity examples

Meaning of annuity:-

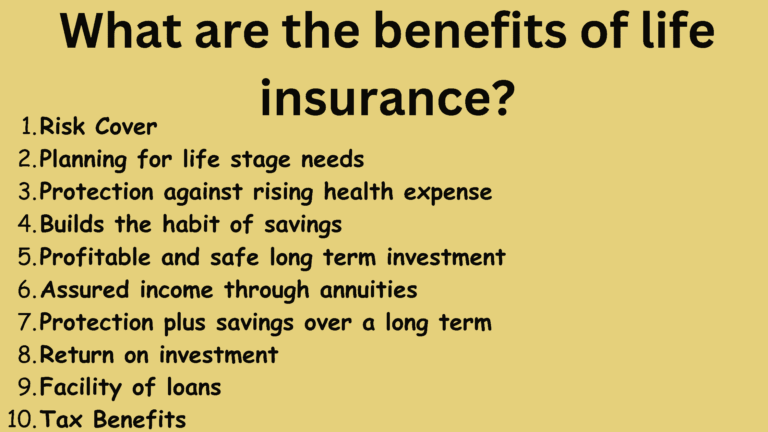

Annuity means a single payment of premium by the annuitant and a promise that the insurer will pay a given amount periodically to the annuitant during his lifetime at a future date. Now we can consider it by comparison with life insurance.

As in the life insurance under contract a lump-sum amount is paid only upon the death of the insured. Whereas under the annuity is payable only upto death therefore, the insurer stops paying upon the death of the insured. However, annuity may be paid in instalments, in return for a promise from the insurer to make a series of payments to him as long as he lives. What is the best example for annuities? annuity examples

TYPES OF ANNUITY

Various types of annuities are as following

- Fixed Annuities

- Variable Annuities

- Immediate Annuity

- Immediate Annuity Certain

- Deferred Annuity

- Joint Annuity

- Qualified Annuities

- Non Qualified Annuities

- Jeevan Dhara

- Jeevan Akshay

- Jeevan Sarita

- Immediate Annuity

- Deferred Annuity

- Jeevan Suraksha

(1). Fixed Annuities:- Fixed annuities are a best tool for the people who are interested in low tolerance levels for risk. So in a fixed annuity, the money is invested in government bonds as well as corporate bonds. These are the safest type of investment avenues and guarantee a regular rate of return. Then the company promised to pay an agreed amount of interest for a predetermined time plus principal in the form of return on the investment. Thus, with this type of annuity an investor will get a guaranteed rate of interest for a number of years. Such annuity is not affected with the fluctuations of market performance. What is the best example for annuities? annuity examples

(2). Variable Annuities:- In such types of annuity investment, investors are willing to take some degree of risk to generate more amounts of profits. In these annuities, investors will choose various aggressive to conservative securities. Such variable annuity makes payment that will rise or fall on the basis of market performance. In such an investment investors do not receive a guaranteed interest rate for a set period of time. However, the overall risk is higher with this type of annuity. However, it provides principal protection. annuity examples

(3). Immediate Annuity:- Such annuity payment is assured throughout life. And it ceases on death. Immediate annuity is purchased with a single premium and the annuity payment begins one year, six months, three months, one month after the date of purchase. What is the best example for annuities? types of annuity. annuity examples

(4). Immediate Annuity Certain:- In such annuity plans, annuity instalments are payable for a specified certain period. But it also involves that guaranteed annuity instalments are paid after the death to the nominee of policyholder as per terms of the contract. However, a certain period normally cannot be less than 5 years. types of annuity

(5). Deferred Annuity:- In this annuity, benefits of annuity become payable only after the expiry of specified period which is called as the deferment period. Such annuity can be purchased with the single premium and instalments of premium payable during the deferment period. But these annuities can be purchased during the working days. But this annuity can be begun after the date of retirement. However, in case of death before the beginning annuity, all annuity would be due to begin during the deferred period the premiums paid to the nominee or the heirs. annuity examples

(6). Joint Annuity:- Where there are more than one annuities this is called a joint annuity. Such annuity is payable until the death of the last survivor of the policyholders. Normally these types of annuity are written on “Husband and wife” in order to guarantee income as long as either they may live in their life. What is the best example for annuities?

(7). Qualified Annuities:- A qualified annuity is that in which amount is invested in a tax favoured plan such an IRA. Under this annuity scheme or plan, the payable amount of annuity is not entitled to taxable income of the investor. All other tax provisions which apply on the non qualified annuities also apply to qualified annuities. annuity examples

(8). Non Qualified Annuities:- In non qualified annuities, money is not invested in the tax favoured plans. Investment earnings from all annuities qualified and non qualified are tax deferred until they are withdrawn. At that point these are treated as the part of taxable income whether income is in the form of dividend or capital gains. annuity examples

(9). Jeevan Dhara:- Jeevan dhara is such a plan of annuities in which involves the living benefits. As it provides both the death protection and living benefits. This annuity contains insurance and annuity. Which is provided to the policy makers during living and after the deaths of him. What is the best example for annuities? annuity examples

(10). Jeevan Akshay:- This type of annuity involves the long term pension and guaranteed insurance sum to the heirs. So it is the voluntary pension plan offering. This plan is to be submitted along with age proof and the amount of single premium. Commencement of the policy occurs on the date when the policy money is deposited. This type of plan is for the employees and people who are self employed like lawyers, Chartered Accountants, Doctors, Architects, Building Contractors, Shopkeepers and Traders.

(11). Jeevan Sarita:- This is a joint type of annuity scheme along with the insurance protection and return of corpus. It provides full protection to the annuitants during the deferment period as well as given to the last survivor annuity. Thus this annuity plan is established for the married couples only. What is the best example for annuities? annuity examples

(12). Immediate Annuity:- This plan is similar to the plan of the existing immediate annuity plan. But the biggest difference is that the purchase price is payable on the death of the annuitant. What is the best example for annuities? types of annuity. annuity examples

(13). Deferred Annuity:- Whether this plan is similar to the existing deferred annuity plan except the notional cash option, which is payable upon the death of the annuitant to the legal heirs or the nominee. What is the best example for annuities? types of annuity

(14). Jeevan Suraksha:- As per the desire this plan can be taken by the annuitant according to his age. It is concerned with the personal pension policy. In such policy policyholder has to pay premium upto the vesting date. It can be taken for a single

- As a single premium without life cover

- Without life cover to certain categories as annual premium

- Endowment type of policy with guaranteed and loyalty additions

- This scheme involves tax benefits u/s 88. What is the best example for annuities?

Conclusion:- Every employee has to secure his life in old age. When income would stop but expenses don\’t stop. So all employees would like such an arrangement which may be helpful in their life of old age. So here are the annuity plans which can be adopted by the employees for the purpose of security to their life. There are different types of annuity plans which can be followed by employees and employers as per their desire. As some plans provide the benefits upto the life, whereas some plans provide benefits after death to the annuitant\’s heirs or nominee.

Note:- There are following answers concerned with the investment. Which must be considered by the investors before the investment. These are following:

Risk determination of investments